您现在的位置是:Bitcoin’s recovery will depend on a lot of macro >>正文

Bitcoin’s recovery will depend on a lot of macro

上海品茶网 - 夜上海最新论坛社区 - 上海千花论坛56人已围观

简介Coinjournal’s Dan Ashmore says numerous factors, including inflation and rate hikes, have affe...

Coinjournal’s Dan Ashmore says numerous factors, including inflation and rate hikes, have affected the prices of most cryptocurrencies.

He told CNBC that Bitcoin’s recovery would depend on numerous macro events affecting the market.

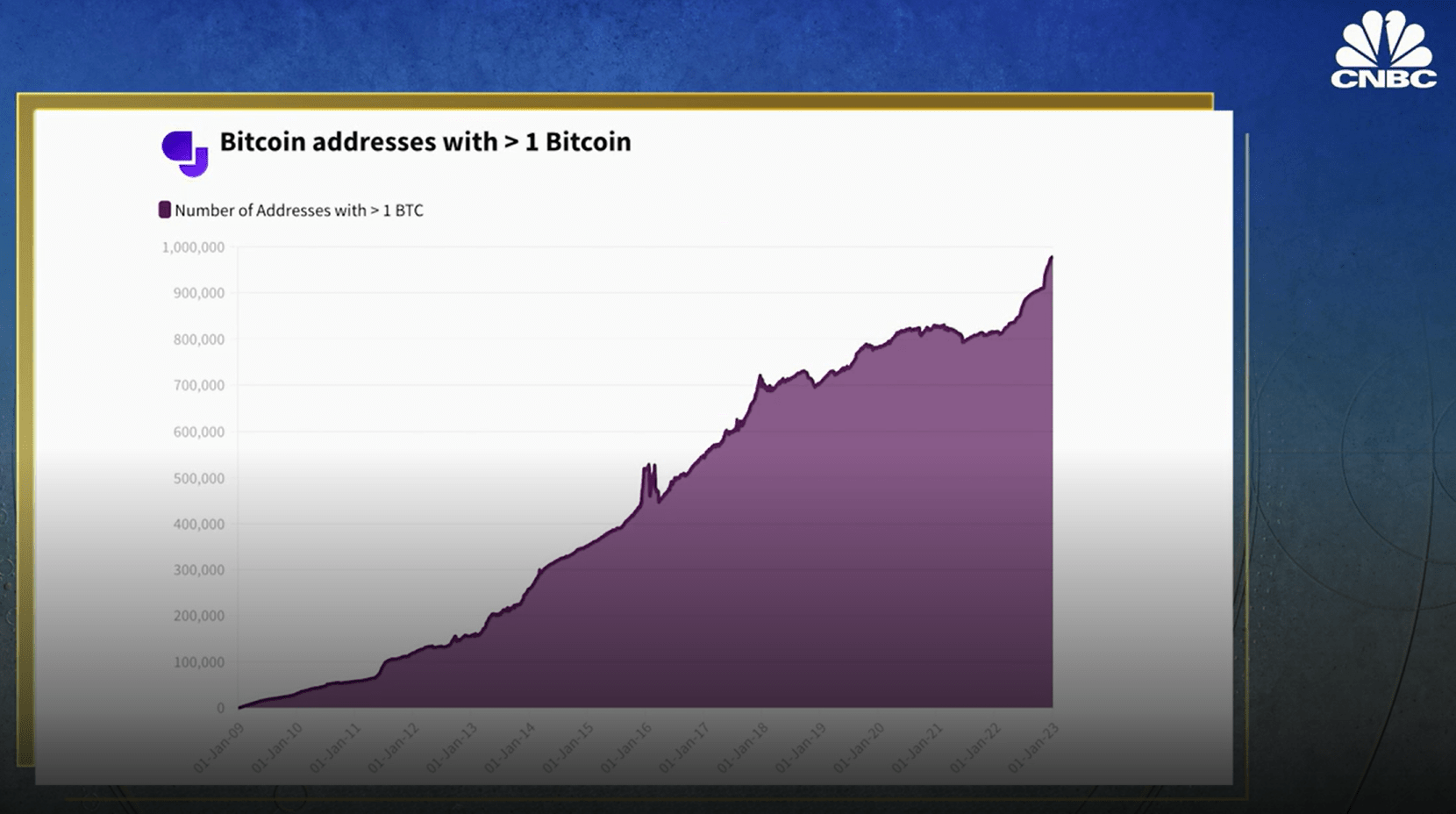

Bitcoin and the broader crypto market have lost more than 65% of their value since the all-time high of November 2021.

Bitcoin’s recovery will not happen overnight

Dan Ashmore, a cryptocurrency analyst at Coinjournal, told CNBCin a recent interview that the price recovery of cryptocurrencies will not happen overnight. When commenting about the price collapse last year, Ashmore said;

“Entering 2022, we were at the tail-end of one of the longest and most explosive Bull Runs in recent memory. And then the world is gripped by this inflation crisis post-pandemic. We also experienced one of the swiftest rate hike cycles in recent memories. That sucked the liquidity out of all these risky assets. It is not overly surprising that we have seen this massive pullback.”

The macro climate will play a role in market recovery

At press time, the price of Bitcoinstands at $21,163, down by more than 60% from the all-time high. While commenting on the possibility of price recovery, Ashmore said the macro climate would play a huge role in that regard. He said;

“In the last month or so, we have seen slightly more positive readings. It still has a long way to go, but it is brighter than it looked a month or two ago. We still have a long way to go before we get back to that $69,000 all-time high. This is not going to be an overnight process.”

He added that the rise depends on a whole range of variables in the macro climate going our way. Furthermore, the avoidance of incidents such as the LUNA, FTX, and Celsius crashes could help boost the market in the long term.

Tags:

转载:欢迎各位朋友分享到网络,但转载请说明文章出处“上海品茶网 - 夜上海最新论坛社区 - 上海千花论坛”。http://www.jz08.com.cn/news/663899.html

相关文章

Nigerian Ministry of Finance to create a framework for crypto

Bitcoin’s recovery will depend on a lot of macroThis is another step towards providing regulatory clarity to crypto in the countryThe Nigerian Feder...

阅读更多

Nexo soars on Binance listing: here’s where to buy Nexo

Bitcoin’s recovery will depend on a lot of macroBinance will list NEXO today at 10:00 UTC, which is when trading will open for NEXO/BTC, NEXO/BUSD,...

阅读更多

3 Best undervalued altcoins on Solana to buy in 2022

Bitcoin’s recovery will depend on a lot of macroSolana (SOL)is a fully decentralised public blockchain that allows the launch and development of sca...

阅读更多

热门文章

- Traders eyeing BTC/USD at $11k as Bitcoin dominance jumps to 61%

- The US collaborates with Brazil to seize $24M in crypto from the fraud scheme

- Binance launches platform for farming new crypto assets

- Stellar price jumps to $0.17 amid EURB news

- BitPay announced a permanent work from home policy yesterday

- Bitcoin loses over 20% in a week, down another 5% today